New business financing

Facilitating new business: Our financial solutions enable our clients to write a higher volume of new business for a given equity base, pursuing market share without significantly depleting shareholder equity. Hannover Re has developed a range of tailored financial solutions that enable our clients to write higher volumes of new business without the need for additional capital or cash resources. Often, they also help the client to enhance its return on equity and stabilise annual earnings.

Loading ...

Developing and distributing profitable products is a key priority for life insurers. However, securing a higher market share and outperforming competitors is often hampered by the strain that new business places on the available financial resources.

Such a new-business strain typically originates from high initial distribution costs and is often amplified by prudent reserving requirements. As a result, not only can an insurer incur an initial strain on its cash position, but, depending on the accounting regime it is subject to, also an initial operating loss. Especially the latter strain stands in stark contrast to the overall expected profitability of the new business and its positive contribution to the insurer’s embedded value. In addition, it often erodes the insurer’s capital base.

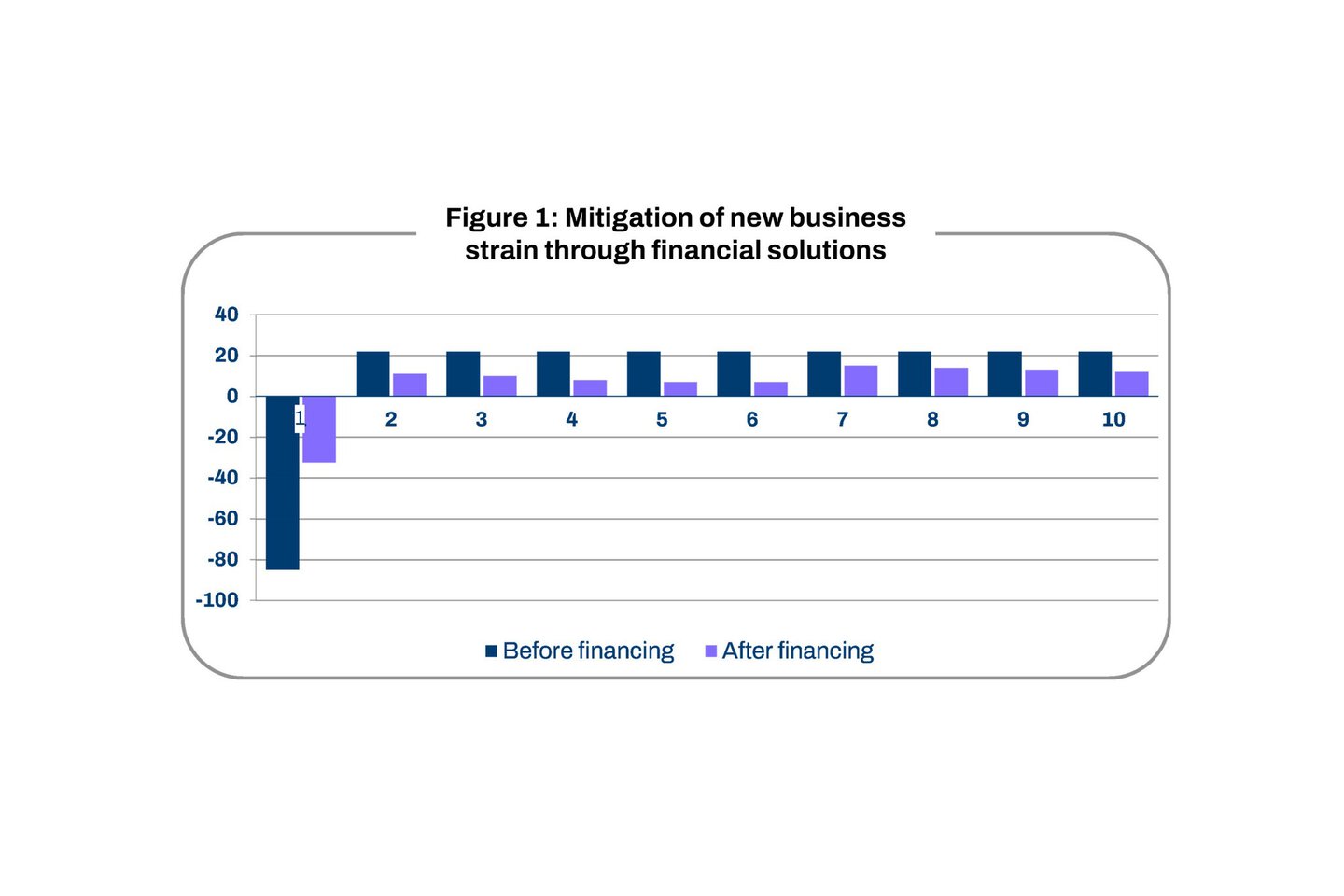

Under such a new-business financial solution, the client receives from Hannover Re an initial reinsurance commission for each unit of new business written. In return, Hannover Re participates in the future surpluses emerging from this new business. Figure 1 depicts how such a financial solution significantly reduces the client’s new business strain. The graph also illustrates that one can structure the arrangement such that it terminates once the initial reinsurance commission has been amortised. This feature ensures that the client can retain any future surplus that is in excess of the amount required for amortisation.

Figure 1

Financial solutions mitigate a new business strain

Profit or cash flow signature

Depending on the client’s objectives, the initial reinsurance commission can either be paid in cash or withheld by Hannover Re. A remittance in cash is usually more suitable if the client incurs a cash strain, but often also helps to absorb an accounting strain. Withholding the commission is a more economical alternative that can help to mitigate an accounting strain. The lower cost of this solution reflects the absence of an initial cash transfer. It can thus be attractive to insurers that do not require liquidity.

Unlike equity or debt, a new-business financing solution is always directly proportional to the volume of policies sold and hence perfectly mirrors the scale of the client’s new business strain. This alignment gives the client precisely the financing capacity it requires - at a cost that reflects only the capacity used.

The type of new-business financing described here is geared towards enhancing the client’s assets. In some instances, for example if conservative reserves significantly contribute to the new-business strain, a liability-reducing structure in form of a reserve relief may be more suitable for the client.