Reserve and solvency relief

Tailored concepts: Hannover Re has developed a range of tailored reserve relief and solvency relief structures. Both help clients to improve their solvency position and free up capital, which then can be redeployed into more remunerative investments or returned to shareholders, thereby often increasing the return on capital.

Loading ...

Reserving and solvency requirements can tie up significant amounts of a life and health insurer’s financial resources. This can limit its ability to pursue business opportunities – in particular, to achieve organic growth – and suppress the return on capital.

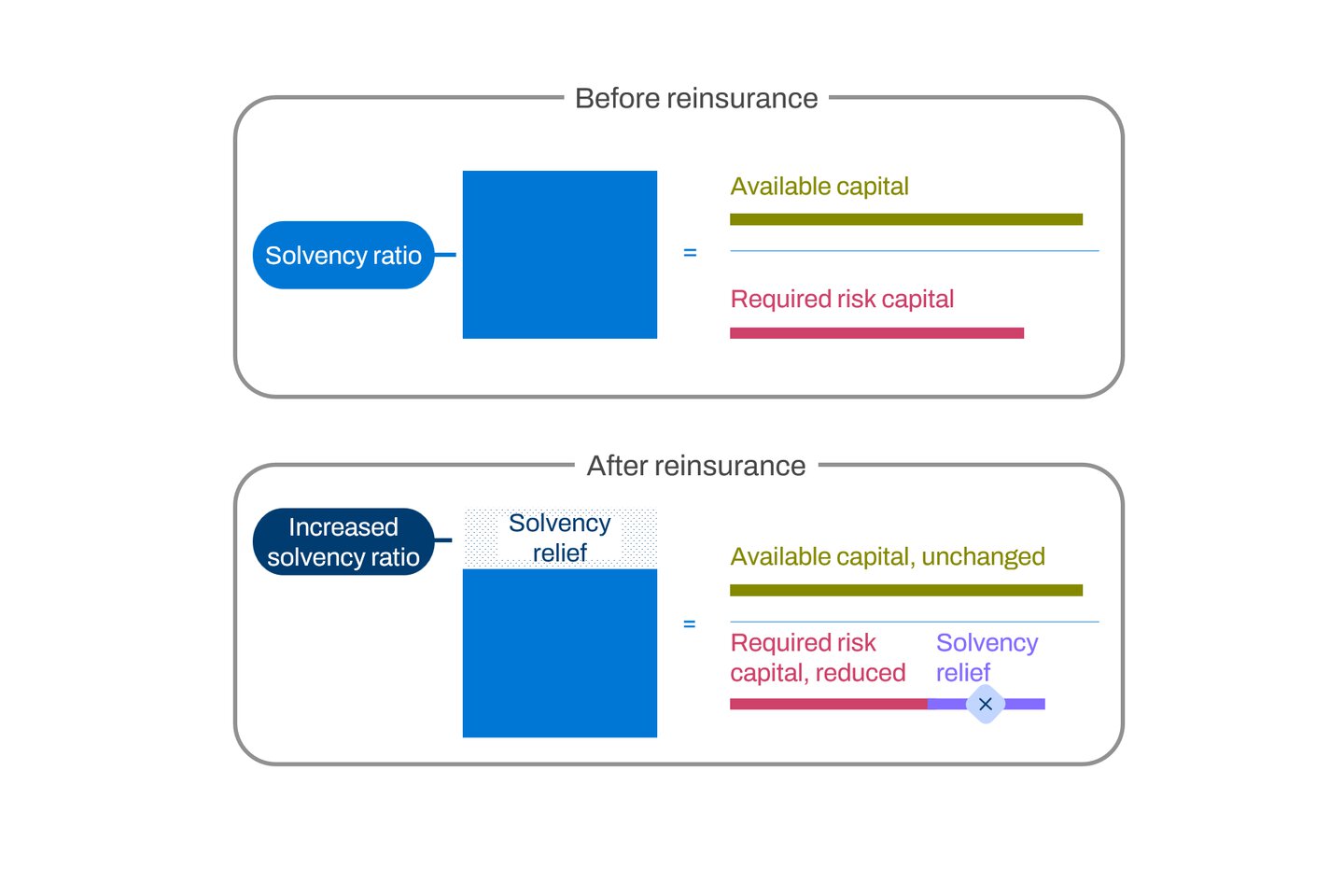

A solvency relief structure reduces the amount of capital the insurer must hold against the risks it faces. The result is, as Figure 1 illustrates, an increase in the insurer’s solvency ratio. It thus allows the insurer to enjoy the benefits of an improved solvency position or to use the freed-up capital to, for example, seize attractive business opportunities.

Figure 1

A solvency relief reduces an insurer’s required capital and thus increases its solvency ratio.

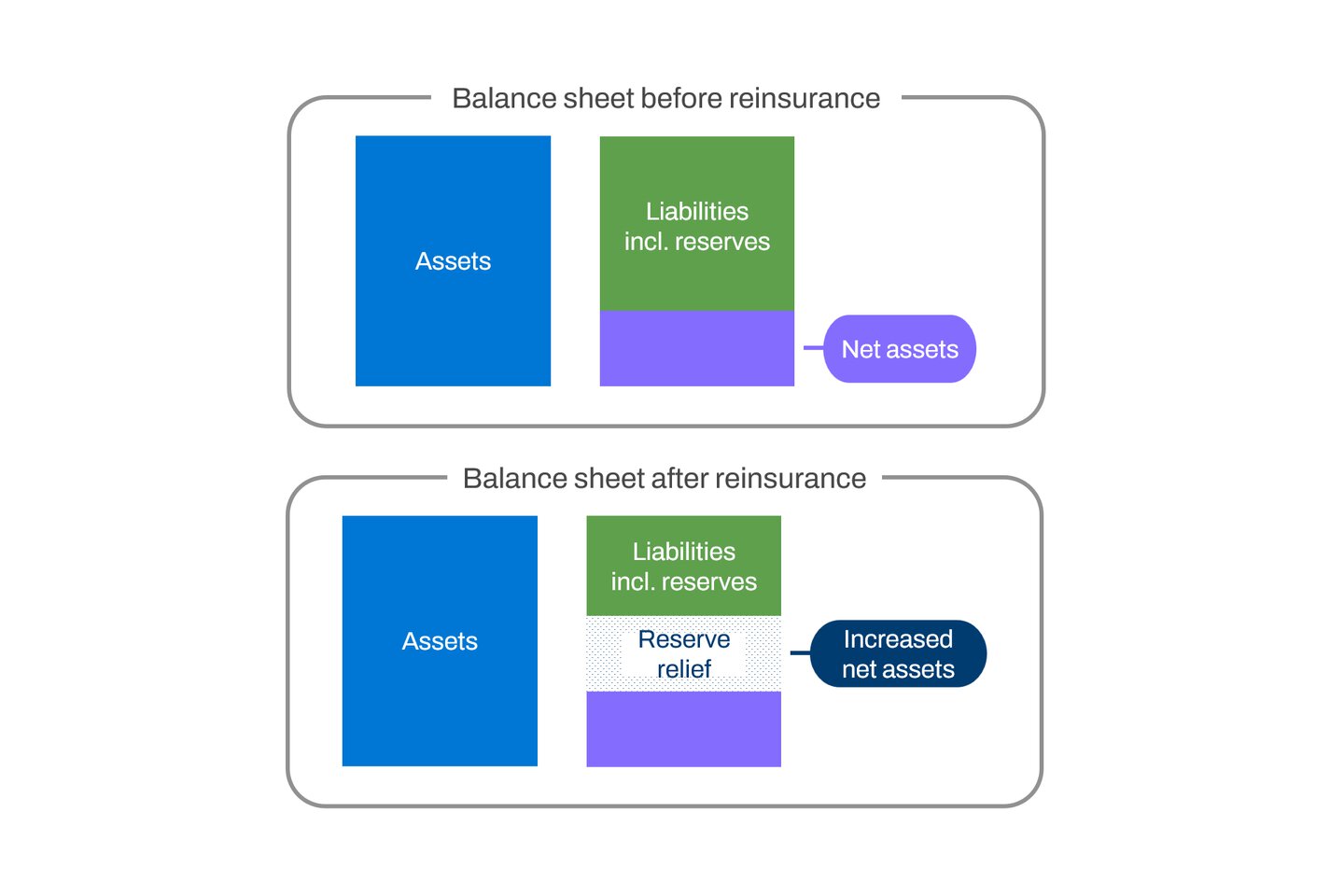

A reserve relief arrangement enables the insurer to reduce its reserves and thus to increase its net assets, as shown in Figure 2.

Figure 2

A reserve relief increases an insurer’s net assets.

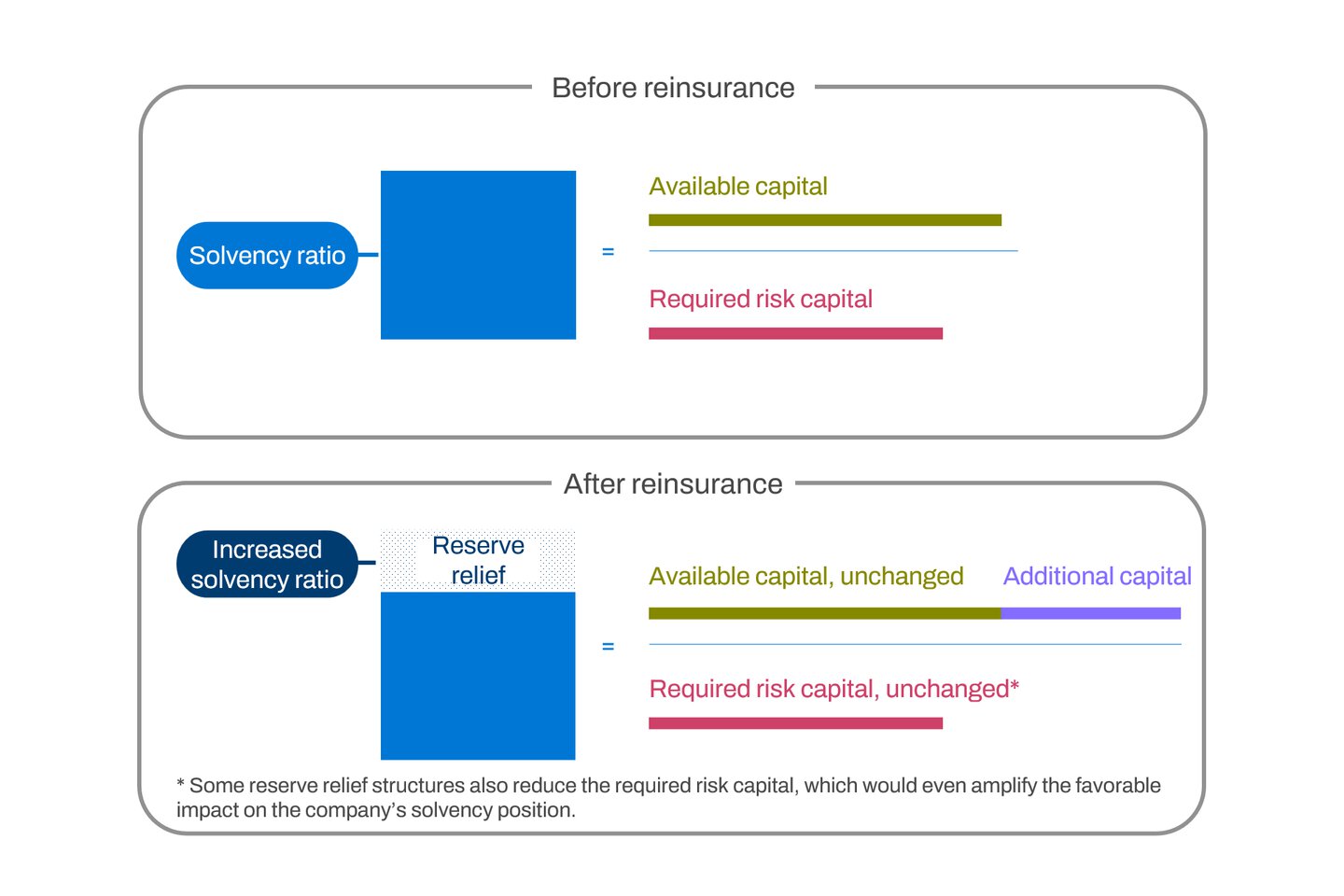

In the solvency balance sheet net assets are broadly synonymous with available capital. Hence, a reserve relief also increases the client’s solvency ratio, albeit in a different way than a solvency relief (see Figure 3). Again, the insurer can now redirect the additionally available capital into, for example, more remunerative investments.

Figure 3

A reserve relief increases an insurer’s available capital and hence its solvency ratio.

Both the reserve and solvency relief structures achieve the desired effect through the transfer of the corresponding risks to Hannover Re. Which solution is more effective will depend in practice on the client’s circumstances and objectives as well as the legal and regulatory regime under which it operates.

Typically, a reserve relief is more appropriate when reserving requirements are particularly stringent and allow for substantial margins against adverse deviation. A solvency relief tends to be the better option when reserving requirements are more realistic but capital requirements are onerous. Often, a combination of the two approaches can achieve the best outcome for the client.

In addition to their main advantage of freeing up capital, both solutions can offer significant ancillary benefits, such as the profit boost that is typically induced by a reserve relief.